Latest Blog Posts

August 15, 2019

August 15, 2019

August 15, 2019

Follow us on Facebook

Certification

CA Private Investigator

License No. 28286

PI Services

Locations Served

Client Intake Forms

Preventing IRS scams

Preventing IRS scams

IRS scams

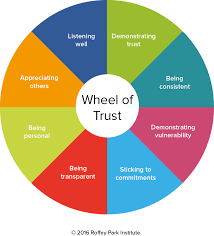

IRS-related scams have ascended by 400 percent this year. In light of the high rate of con artists asserting to speak to the IRS, the genuine IRS has been attempting to teach people in general about what the office’s real conventions are for gathering charge debt. But here’s the place things get confused. In spite of the fact that the Internal Revenue Service is attempting to build up consistency and citizen trust keeping in mind the end goal to eliminate tricks, Congress as of late passed a measure requiring the IRS to contract with private obligation gathering organizations.

This implies outsiders will now be endeavoring to gather back expenses from a few citizens even under the least favorable conditions conceivable time. So how would we separate between an organization procured by the IRS and a con artist guaranteeing to be subsidiary with office? In today’s post, we’ll offer three rules that will ideally help. Guideline #1: Always check your mail before trusting calls from the IRS or its outsider gatherers.

The IRS quite often sends letters to reprobate citizens before attempting to get in touch with them on the telephone. Outsider gatherers will probably take after the same convention. On the off chance that the main reach you get is a telephone call, you ought to be extremely suspicious of who is really calling. Guideline #2: Never make installments via telephone.

Despite the fact that the IRS will be working with outsider obligation gatherers, all installments must be straightforwardly prepared by the IRS. No IRS operators or subsidiary outsider ought to request installments to be made via telephone (this simply does not happen). In the event that somebody on the flip side of the telephone requests your financial balance data or credit card number, you are more likely than not conversing with a con artist. Guideline #3 : Do not give out delicate individual data via telephone.

The IRS definitely knows essential data like your Social Security number. Also, any outsider gatherer working for the IRS would not have to request this data – notwithstanding for “check” purposes. Kindly don’t give out delicate, private data in a telephone call. As a last note, please recall that no assessment matter is so dire as to request quick activity.

On the off chance that you are uncertain about whether an IRS-related correspondence is genuine, take an ideal opportunity to do your examination. By going internet, finding the telephone number and calling the IRS straightforwardly, you ought to have the capacity to confirm whether a specific outsider gatherer is authentic.

The post Preventing IRS scams appeared first on Blue Systems International.